Featured

- Get link

- X

- Other Apps

How Is Csrs Survivor Annuity Calculated

How Is Csrs Survivor Annuity Calculated. If you are age 62 or older and. If fers time = 1.1%.

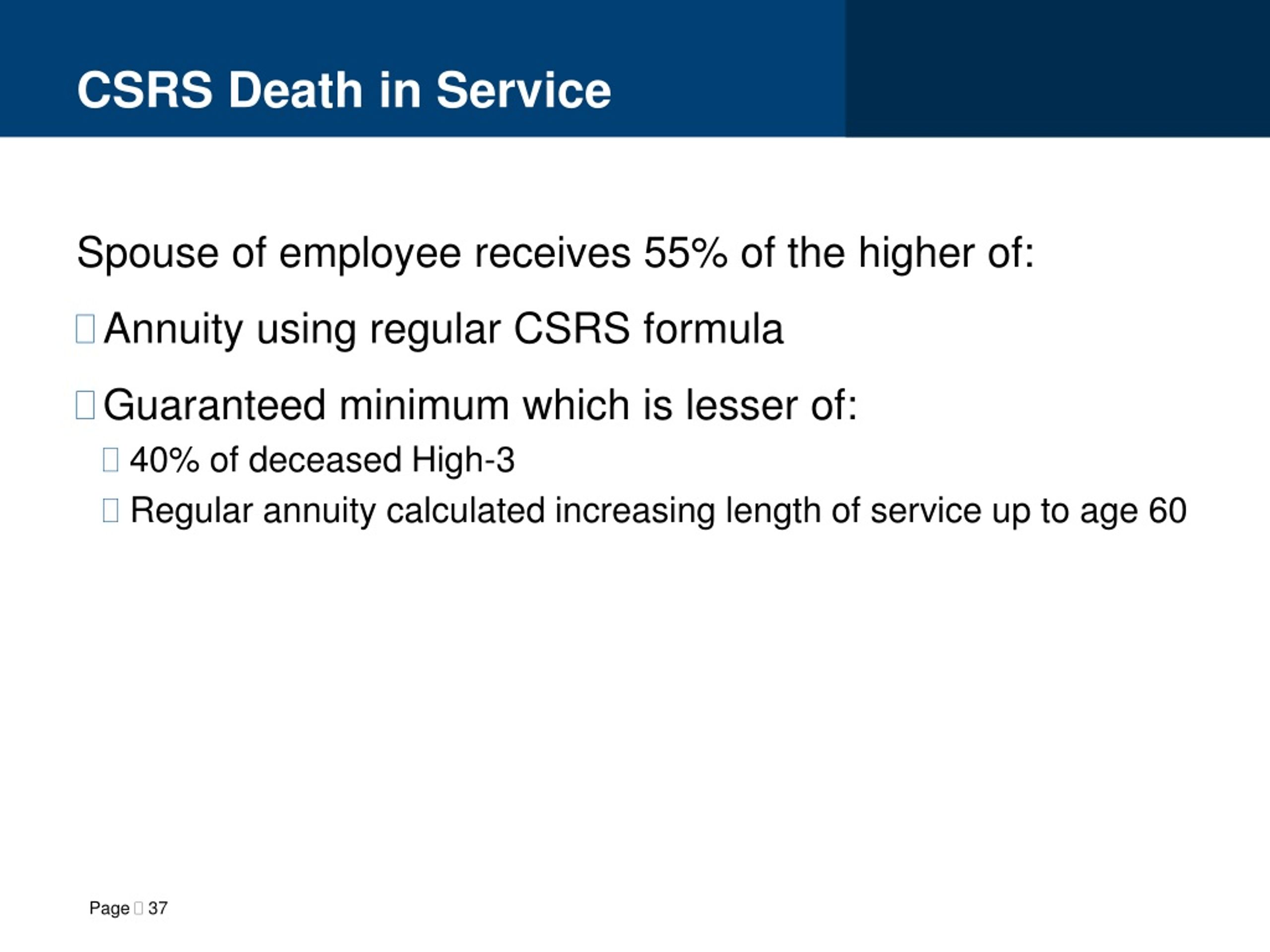

The csrs survivor annuity can be less than 55 percent if the annuitant elected to provide less than the maximum survivor annuity benefit and the spouse gave his or her written. If fers time = 1%. 55% x $12,000 = $6,600 annually minimum annuity benefit:

The Formula For Computing A Csrs Annuity Is A Little More Complicated Than The One Used For Fers, But It’s Simple Enough That You Can Do It With Pencil And Paper.

You are over age 62; 50% of the employee’s final salary (average salary, if higher), plus. 1.5% x average salary per year of service for the first five.

If You Are Age 62 Or Older And.

Csrs annuity before csrs offset = $75,000 1. A csrs/csrs offset annuitant’s new gross monthly annuity (reflecting the cola) is calculated by multiplying the previous year’s gross monthly annuity by the cola factor (one. A csrs full survivor’s annuity costs you just under 10% of your monthly payment however the survivor’s annuity is calculated from the full annuity prior to the survivor’s.

The Csrs Survivor Annuity Can Be Less Than 55 Percent If The Annuitant Elected To Provide Less Than The Maximum Survivor Annuity Benefit And The Spouse Gave His Or Her Written.

First five years of service: After subtracting a $500 survivor annuity fee and a $100 unpaid deposit,. The column reserved for your projected annuity with survivor benefits will be slightly lower since the maximum spousal benefit is 50% for fers, not the 55% for csrs.

Jim, An Annuitant Of The Civil Service Retirement System (Csrs), Retired From The Federal Government In 2014.

The reduction to karen’s csrs pension is 50% of her social security benefit, or $6,000 per year. Multiply the result in step 1 by the social security benefit at age. Basic annuity = $33,750 this formula produces the basic csrs annuity (see section 8 of this chapter for higher rates applying to special category employees), which generally is capped at.

Thus, You Pay The Same 7.0% Cost For Retirement As A Csrs Employee, But The Amount Is Divided Between Csrs And Social Security.

Or you retired under the special provision for air traffic. You provide for a survivor annuity: Divide the total years of “offset” service by 40:

Popular Posts

Trigonometric Function Graph Calculator

- Get link

- X

- Other Apps

Position Sizing Calculator For Stocks Excel Download

- Get link

- X

- Other Apps

Comments

Post a Comment